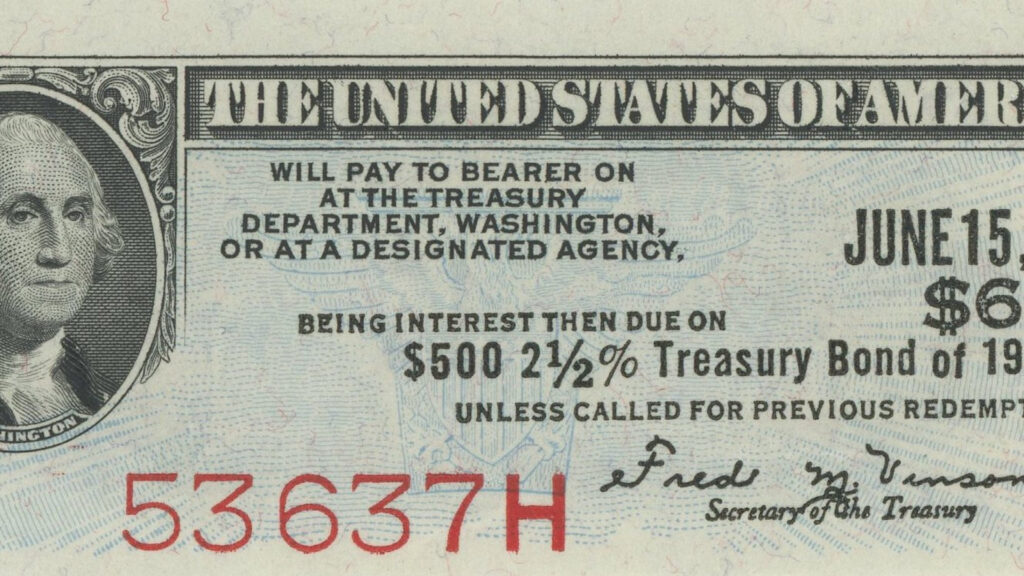

According to Axios yesterday in a short note, they reminded us that banks in the United States are holding three trillion dollars worth of Treasury bills in their vaults. Here’s the thing: if there’s a default, what will those Treasuries be worth? Let’s discuss that.

Thought experiment. It’s June 12th, and there’s no lifting of the debt ceiling. Addlepated Joe won’t invoke the 14th Amendment or claim a platinum coin to continue payments. I suspect he vowed after the Republican Senate lowered taxes for the rich under Trump never to negotiate with terrorists called R people again. That wasn’t very well worded, but you get the idea. So the game of chicken will go to the end. But who is Ren and who is the bully? Recall from Footloose, Ren, aka Kevin Bacon, Five Degrees of Separation man, got his Converse sneaker shoelace caught around the gas pedal and couldn’t jump off the tractor. He looked brave, but instead he was stuck. I think that’s, ironically, the other Kevin, aka McCarthy the hapless. If he blinks, he loses his speakership. If he stays the course, he’ll try to blame AJ, aka Addlepated Joe. So that makes AJ the bully who will end up in the canal across from his overturned tractor .

So back to my point. The United States, for the first time in its history with the exception of a few technical defaults, will declare itself closed for business and shutter the payment window. At first, there should be no discernable impact. Gee, must be ok. A week goes by. Now it’s June 19th, 2023. On the 14th of June, we will not have received my Social Security deposit. Others like me but more dependent on that money, will be subjected to a barrage of requests for profile from the likes of CNN, New York Times and The Washington Post. We’ll be shaking our fists, or moaning about not being able to pay our debts. Axios will profile the blame game from D.C. My Home Depot store will be practically empty. A few contractors will buy a little paint here and there, but customers will cancel the work because they aren’t sure if they will be receiving their Social Security, Veterans Retirement, and all the other payments that go out from the Treasury. That affects 52% of Americans. Not a small number.

What happens next? Those in the rest of the world who hold the bulk of Treasuries will sell them – at any price. 80% of that is held by two countries, China and Japan. China at $870 billion can afford to do that, and they wish us harm. Japan at a trillion dollars can’t afford to do that, their leadership isn’t strong and they will worry about their balance sheet more than our ability to protect them from China. So the price of Treasuries would drop to near zero. That makes interest paid on those remaining go up – way up. Inflationary? You betcha. But what about those $3 trillion in Treasuries in the vaults of those banks? Nothing has really changed about the bank’s holdings in real terms. But on paper, their ability to pay depositors their money has disappeared. Result? Massive run on banks that will make Silicon Valley and First Republic failures pale in comparison. Now we’re talking Citibank, Wells Fargo, Bank of America and Chase. Shades of 2008 all over again.

So will smart bankers start to slowly sell their Treasuries even before the default, having done a similar thought experiment to mine? If they do, same result over time. So even the anticipation of a default could be inflationary. This is a most dangerous game being played in D.C. It is very similar to my previous post about Weimar Germany wanting to get out of reparations, and violating the Versailles Treaty to do it. Bruning and Schacht. The impact from that poor decision was a significant continuation of pain in The Great Depression. It wouldn’t surprise me if we see a similar outcome here.

So what is one to do? Since half the country will be in the same boat, it is very difficult to say. When this is over, inflation will be soaring. That will make the value of my house go way up, and my credit card debt will be devalued. But here’s the thing: what happens to my reset mortgage in September when interest rates are 20%? I’d have to sell my house. But who will buy it at those levels? Nobody. That will apply to everyone else in my situation. Oh, but wait. Think about all those people who refinanced when interest rates were near zero during Covid? The banks won’t be getting enough income to offset interest rate increases. Another hit to their holdings. Ouch. In my case, Wells Fargo will have to settle for something less in a monthly payment. Real estate market frozen all over the country.

Depression coming. This is what I sensed over the last few weeks. So we’ll keep talking about it. Strange times.