It appears everybody’s figured out that one of my two pieces of advice were correct in my post-election post. You remember – the one about a new  ‘CCC’ – to teach young people skills needed to work on improving the country’s infrastructure? Two eminent economists –

‘CCC’ – to teach young people skills needed to work on improving the country’s infrastructure? Two eminent economists –  Nouriel Rubini and

Nouriel Rubini and  Jeffrey Sachs – have picked up the infrastructure banner. Both are waving it wildly.

Jeffrey Sachs – have picked up the infrastructure banner. Both are waving it wildly.

Jeffrey says spending money on infrastructure will signal to the private sector that it’s safe to go back in the water – i.e., safe to begin to invest in one’s business again. What he forgot to add is the need for stability and predictability from Congress, the courts and the executive branch. No surprises means more stable economy = business will begin to invest in themselves again.

Rubini’s latest missive says the central bankers of the world have done all they can to stimulate their respective economies. We need to forget the mistakes of the past  (Germany and the EU) and move forward, spending money to invest in infrastructure that’s frankly worn out since we haven’t built anything new since the post-war decade or two.

(Germany and the EU) and move forward, spending money to invest in infrastructure that’s frankly worn out since we haven’t built anything new since the post-war decade or two.

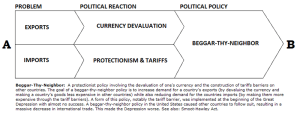

Obviously I agree with both gentlemen, having espoused this philosophy fairly continuously since – well, since I’ve been blogging. But here’s the thing – isn’t there always a thing? The thing is, all our neighbors are beginning to play the  beggar-thy-neighbor policies in earnest. Remember what that is? Each country is working hard to keep the value of their currency at lower & lower levels, relative to the almighty American $. This will, in turn, strengthen the dollar. And what happens when the dollar gets stronger, other than our exports get more expensive and therefore we sell less? More money comes to the U.S. from world-wide investors. This feeds money that goes into – what?

beggar-thy-neighbor policies in earnest. Remember what that is? Each country is working hard to keep the value of their currency at lower & lower levels, relative to the almighty American $. This will, in turn, strengthen the dollar. And what happens when the dollar gets stronger, other than our exports get more expensive and therefore we sell less? More money comes to the U.S. from world-wide investors. This feeds money that goes into – what?  Real estate and securities. So those prices go up. This is good for the American economy, right? Well, yes, correct – as long as we keep the lid on, and don’t let things get out of control. Like we did with Alan Greenspan at the helm of the Fed from 2001 to 2006, when the bubble economy nearly did us in – done in by people losing their jobs and not being able to maintain their debt load.

Real estate and securities. So those prices go up. This is good for the American economy, right? Well, yes, correct – as long as we keep the lid on, and don’t let things get out of control. Like we did with Alan Greenspan at the helm of the Fed from 2001 to 2006, when the bubble economy nearly did us in – done in by people losing their jobs and not being able to maintain their debt load.

But all that said, all that money coming into the US doesn’t really add any jobs. Where do jobs come from these days? New jobs are being created in most of the sectors: retail, health care and the service sector, with a smaller quantity from manufacturing and construction. How can we boost employment in construction and manufacturing? OF COURSE! The government invests in  infrastructure improvement.

infrastructure improvement.

But do we have the people needed to build roads, fix bridges, upgrade water plants? Probably not. Part of my original thinking was that we must – first and foremost – teach young people the skills they need to contribute to infrastructure improvement. Skills like carpentry, electrical, GIS and CAD skills. Bring back the Vo-Tec school in a big way…connect that education to a guaranteed job, and we’re off to the races. Not the Job Corps that taught outmoded skills because of lack of decent program funding – a new, modern program along the lines of what is happening in the for-profit sector. How about public/private partnerships between Middle & High Schools/Unions and Community College vocational programs? Now that’s a really good idea.

Kids grow up really fast these days – we can’t wait until they’re in the twenties to work with them. We actually should start in middle school, with internships and the like to encourage kids to go in this direction. What’s the alternative? That most hated group since the North Koreans –  illegal immigrants. Hordes of ’em. Flooding across our very porous borders. They’ll do the welding, steel erection and laborer work. And they’ll do it for cheap, sending half their pay home to Mexico, Guatamala and other parts foreign. And won’t that just drive the

illegal immigrants. Hordes of ’em. Flooding across our very porous borders. They’ll do the welding, steel erection and laborer work. And they’ll do it for cheap, sending half their pay home to Mexico, Guatamala and other parts foreign. And won’t that just drive the  Republicans nutso crazy? You betcha. So the bipartisan thing to do is fund some of these programs NOW, and avoid the labor shortages that surely will accompany the letting of these contracts. It’s really very simple, now isn’t it?

Republicans nutso crazy? You betcha. So the bipartisan thing to do is fund some of these programs NOW, and avoid the labor shortages that surely will accompany the letting of these contracts. It’s really very simple, now isn’t it?