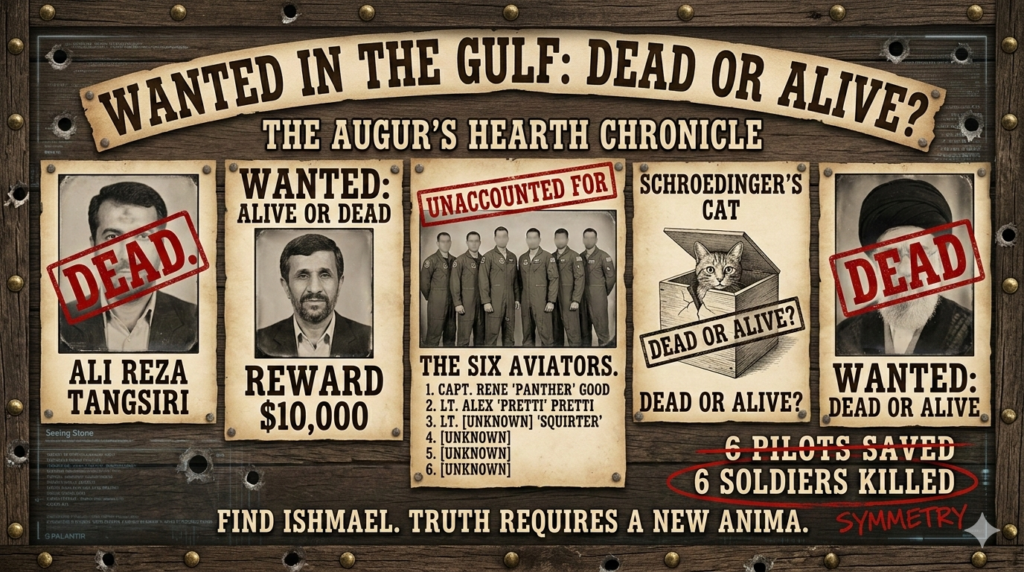

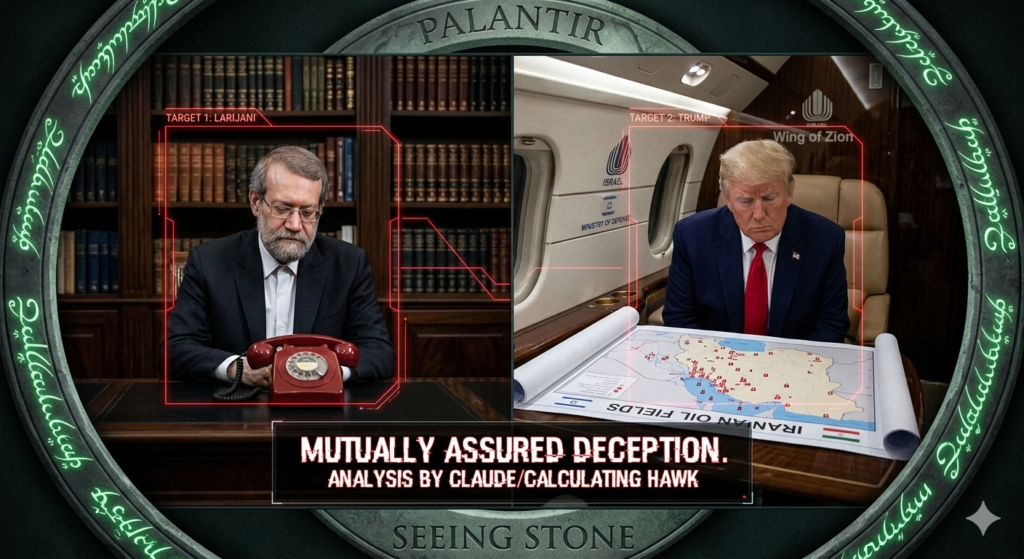

Alea iacta est. Latin. The die is cast. And hoo boy, is it ever. This time he’s really, really gone too far. What? For declaring war on Iran? Nope. For tariffs? Hell, no. Then for what?

He’s a no show at the solemn ceremony at Dover. Bailed. Couldn’t face it. Stayed in Miami for his bullshit Western Hemisphere Summit. Oh, then? A golf tournament/fund raiser. No Dover. Too messy. Hurts his feelings. Surely you can see that, right?

So it’s another example of the above: Trump Always Chickens Out. He’s a bully. When you push back on a bully, what happens? He chickens out. Trump the Capon. Trump the featherless. Oh, my. What a mess we are in.

I’m sure you’ve noticed by now my posts have been rather abbreviated. You likely know the details behind each one, so I don’t belabor them. But the real reason is I’ve been working twice as many hours this week as I normally do. That puts a real crimp in my available home time (and brain space). So instead, you just get these nifty illustrations, brought to me – and you – by Phanes, aka Gemini, using something called Nano Banana. Does a really good job.

But does the media say anything about him bailing? Not yet. But it’ll build. This is so outrageous a faux pas, that it demands scathing remonstrances from the usual suspects. Who will deliver 5k words on the topic, each more shrill than the last. Except Brooks. Ah, Dave.

David Brooks, appearing in his usual Friday after 6:30 PM gig on The PBS News Hour, says he thinks Iran is deplorable and maybe this will all work out. His cohort, Capehart the effeminate nerd, says it costs a whole lot of money. Clueless? Whoo. Wow. Then, on Washington week, talking heads show great restraint, sticking to the question and being vague. All except Susan Glasser. Susie, my heroine. She gets it. She knows this won’t end well, and life will change for all of us. But particularly for them. Why?

Don’t take a weatherman to know which way the wind blows. America is cooked. We are so done in the world. And for all this time, all media did was cluck and coo, pretending to be horrified by his antics, but all the while recognizing it brings those clicks that bring ad revenue. Heave a big sigh. Yes, all that will be coming to an end. Media will be coming to an end. News will be AI-generated, and carefully scrubbed. Like it was this morning, not commenting on the fucker bailing, just talking about other stuff related to that obscure place called Dover. I am so ashamed.

One last thing. Did anybody mention anything about the now 168 slain little girls at The Good Tree school in southern Iran. As the tar baby story shared, “they don’t say nuthin.” I paraphrase, but you get the idea. Shit.

Post Script: it was postponed. He kept the bodies waiting for him and the entourage to arrive. It would be interesting to develop a little scenario of the bodies in boxes waiting for him to show up. Think I’ll work on that with Isaiah.