Would you agree with the premise that we are meant to see and hear that which we are meant to see and here? Perusing the iPad this morning, saw a reference to a podcast involving Adam Tooze. It came from an interview from Berlin.

Adam said he insisted on talking about the debt ceiling “default crisis” and got to the topic after an agonizing 15 minutes or so of small talk about learning German in his upbringing. And from the mouth of this very brilliant historical economist (the best kind there is!), came the words “it’s no big deal, even if they default a little bit.”

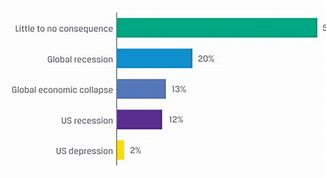

That surely explains why the markets have been so calm, despite the brinksmanship going on, even as we speak, in D.C. Because the dollar is so well entrenched as the global reserve currency, the impact on a brief, albeit scary default will be nil on the world economy. Well, that’s a big ass relief! But that’s not what I came to talk about.

I want to talk about inflation instead. After his words about the default, I suppose by way of explanatory detail, he talked about the relationship between the strength of the dollar, oil and inflation. This is the first time anybody has put those things together for me. After hearing what he said, I practically slapped my forehead. Of course!

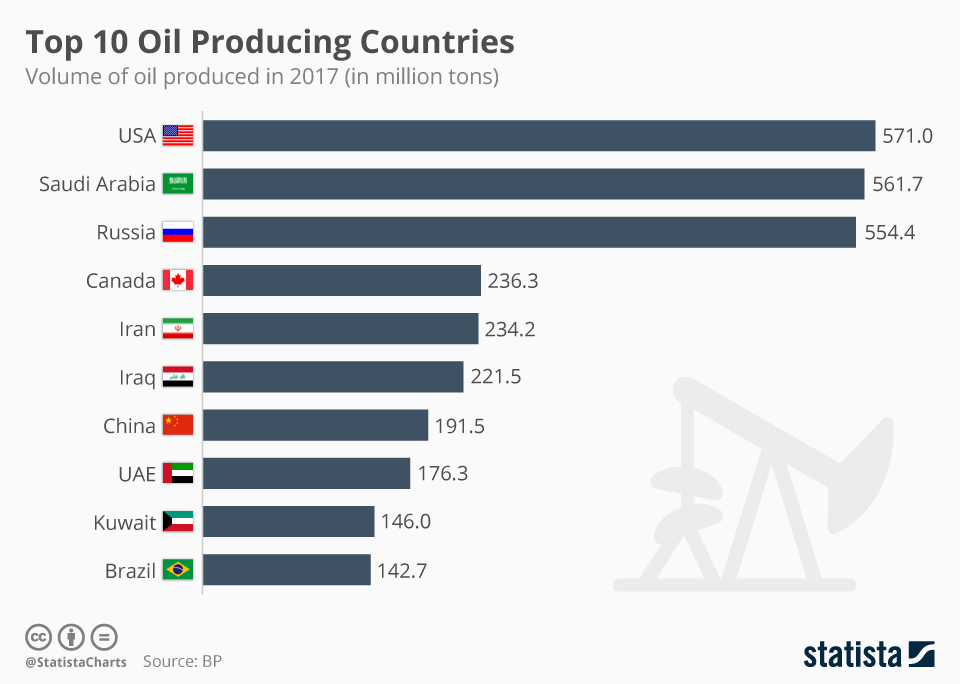

So what is it, you ask? Geez..irony. I’ve been talking about this stuff for the past decade, but I never connected the dots. Here’s the story. Back when we were net importers of oil – say up to earlier in this decade – there was an inverse relationship between oil price and the strength of the dollar. Think about it. A stronger dollar means we could buy more oil per unit than if the dollar weakened. That makes each one cheaper. Makes sense.

Conversely, weaker dollars meant the money paid for oil imports would push the unit price up. OK, that’s not so straightforward. But if the dollar is the reserve currency that everybody trades in, what would affect the US would also affect those other countries paying dollars for the oil they import. Like Japan. Or Sri Lanka.

Sri Lanka, you ask? What have they got to do with this? I’ll get to that in a minute. Keep your shirt on. OK. Where was I? Oh yes – something changed. This decade. Fracking. The logistics solved of exporting our abundant LNG – liquid natural gas. When the Russians cut off Western Europe in the leadup to their invasion of Ukraine, who stepped it to fill the breach, foiling Vlad the Invader’s ignorant plans? Yup – we did.

OK, still not following. Back to Adam Tooze, my hero. He points out that now the US is a net EXPORTER of petroleum products. So now when the dollar gets stronger, we are selling oil in dollars. More expensive oil. So countries that import lots of oil (cue Sri Lanka) had a tough time finding the money to pay the tab. So they tried to reduce imports to save money. What happened? Rioting in the streets when people couldn’t cook their dinners because there was no fuel. So what did Sri Lanka do? They defaulted on their debts.

So that is a real default. What Washington is playing around with I’ll start calling a ‘political’ default. It’s not real. In fact, the moderator pointed out that JP Morgan said AFTER the default, Treasuries will increase in value. Talk about your law of unintended consequences. Adam didn’t dispute the suggestion; it led to the facts discussed above.

But hey, you point out, you said you wanted to talk about inflation, not oil, reserve currencies and Sri Lanka. Yeah. Right. Let’s talk about inflation relative to all of the above. The basics. Emily, please recite. “Inflation is too many dollars chasing too few goods.” We’ve talked about that before with respect to Covid. Then there were too few goods. Now let’s talk about this oil and the strength of the currency. The more oil we sell, the more dollars flow into the coffers of the country. Yes, you say, but those are private companies, not the government. Economies don’t differentiate. Record profits for oil companies. Google what Exxon paid in income taxes for the past two years since Covid. See how private dollars turn into public dollars? All that money means too many dollars chasing the same number of goods or less. Inflation. So the Fed raises interest rates, like this was 1971 and the problem was labor. Stupid – no, not stupid, political again. Must do something to protect the brand called The Government, even if it’s the wrong solution that will make things WORSE for its citizenry. Like Sri Lanka defaulting made things worse for its populace.

So now, let’s take a step back and analyze. The much touted need in previous years for ‘oil independence’ status has had the net effect of making everything you buy more expensive, coming after the effects of a global pandemic. What’d a predicted that?