Thomas Hobbes

Leviathan

Let’s talk about things economic this morning. The European Union has finally figured out that they should have done Quantitative Easing about, oh 8 years ago. Now that the horse left the barn, traveled to the neighbor’s  garden and ate all the daffodils, then went to the pond and drowned, they’re finally shutting the barn door. Figuratively speaking. Let me ‘splain.

garden and ate all the daffodils, then went to the pond and drowned, they’re finally shutting the barn door. Figuratively speaking. Let me ‘splain.

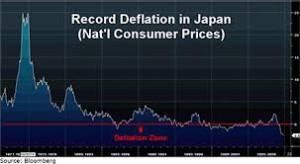

The EU has been caught in what is usually called a “Japanese-style”  deflation for the past 8 years. It’s called “Japanese-style” because the Japanese have been in deflation for 20+ years. OK, so is that so bad? Not if you’re old and retired. Because if things get cheaper over time, your social security goes a lot farther than if prices increase. But what if you’re young and looking for a job? Trying to earn enough to have a family? Cheap prices don’t help if you don’t have sufficient income to buy things. So deflation hurts the young. And let’s be frank: the world is at war with workers. If employers can get by with fewer workers, they will. If they can deprive people of benefits, they will. The worker today is truly an oppressed individual. Kind of like during the

deflation for the past 8 years. It’s called “Japanese-style” because the Japanese have been in deflation for 20+ years. OK, so is that so bad? Not if you’re old and retired. Because if things get cheaper over time, your social security goes a lot farther than if prices increase. But what if you’re young and looking for a job? Trying to earn enough to have a family? Cheap prices don’t help if you don’t have sufficient income to buy things. So deflation hurts the young. And let’s be frank: the world is at war with workers. If employers can get by with fewer workers, they will. If they can deprive people of benefits, they will. The worker today is truly an oppressed individual. Kind of like during the  1930’s.

1930’s.

Since the world’s demographics have been aging, it kind of makes sense that many countries would find a comfort zone in deflation. But it’s a dangerous thing. Growth is the key phrase here, and deflation means negative growth. Negative growth means unemployment or at the very least, underemployment for the younger generation. Unemployment for the younger generation has historically led to unrest. The most recent examples of this can be found in the Middle East, with the so-called  Arab Spring. As previously discussed, the A.S. didn’t work out too well for those young folks. Nothing changed, and a lot of them

Arab Spring. As previously discussed, the A.S. didn’t work out too well for those young folks. Nothing changed, and a lot of them  died trying to send their elders a clear message about the perils of too many young people with nothing to do.

died trying to send their elders a clear message about the perils of too many young people with nothing to do.

So now the EU is going to buy unlimited quantities of European bonds of all kinds, trying to inject money into a system that has had  austerity as its byword for the past 8 years. Will it fix the problem? Likely not, according to

austerity as its byword for the past 8 years. Will it fix the problem? Likely not, according to  Larry Summers, the really smart guy that coined the phrase secular stagnation. Will it hurt? Likely not, but what’s the point of doing it now? Because they never could agree on a tonic for their economic ills before. Now they are faced with increasing unrest and the potential for some nasty governments to get elected. Sunday will be Greece’s election, and the bookie money is on

Larry Summers, the really smart guy that coined the phrase secular stagnation. Will it hurt? Likely not, but what’s the point of doing it now? Because they never could agree on a tonic for their economic ills before. Now they are faced with increasing unrest and the potential for some nasty governments to get elected. Sunday will be Greece’s election, and the bookie money is on  Syriza to win. Syriza is running on a platform of reneging on the debt to the EU. Maybe. Or maybe it’s just politics as usual, pandering to the mob until you get elected, and then finding the middle again. It is a dangerous game that adds fuel to the fire of revolution. And as we know from history, it just takes a spark and then all those simmering ills under the surface boil over and violence ensues. Gonna happen…sooner or later.

Syriza to win. Syriza is running on a platform of reneging on the debt to the EU. Maybe. Or maybe it’s just politics as usual, pandering to the mob until you get elected, and then finding the middle again. It is a dangerous game that adds fuel to the fire of revolution. And as we know from history, it just takes a spark and then all those simmering ills under the surface boil over and violence ensues. Gonna happen…sooner or later.

So what to do? Ah, that is the question. At this point, each country is just worried about its own. Larry is concerned the Federal Reserve in the U.S. will tighten too soon, posing a threat to the incipient recovery in America. Well, Larry, you’re probably right, but since  Janet Yellen, the Chair of the Fed is a smart lady, she will likely try to stave off this notion about raising interest rates. Why is it a bad idea? Because raising interest rates means dollars will flood into the U.S. from other countries. Why? Because countries like Sweden and Switzerland have negative interest rates. Yes, negative. You put a dollar into your savings account, and when you take it out a year later, you get $0.90. Even an 11 year old could figure out that’s not a good idea. So money from overseas will flood into the U.S., strengthening the dollar even more. The dollar is already on an upward trajectory, because of the difficulties in Europe, and in particular Russia’s challenges with

Janet Yellen, the Chair of the Fed is a smart lady, she will likely try to stave off this notion about raising interest rates. Why is it a bad idea? Because raising interest rates means dollars will flood into the U.S. from other countries. Why? Because countries like Sweden and Switzerland have negative interest rates. Yes, negative. You put a dollar into your savings account, and when you take it out a year later, you get $0.90. Even an 11 year old could figure out that’s not a good idea. So money from overseas will flood into the U.S., strengthening the dollar even more. The dollar is already on an upward trajectory, because of the difficulties in Europe, and in particular Russia’s challenges with  depressed oil prices. A stronger dollar hurts exports, because it takes more of the foreign currency to buy those American products. That portion of the U.S. economy, currently growing, will suffer. In other words, it will hurt economic growth. And right now, the U.S. is likely the only country in the world with positive growth. Even China, which often doesn’t share all their economic data, may be experiencing deflation. It’s a highly contagious disease – like the measles currently making the rounds in California.

depressed oil prices. A stronger dollar hurts exports, because it takes more of the foreign currency to buy those American products. That portion of the U.S. economy, currently growing, will suffer. In other words, it will hurt economic growth. And right now, the U.S. is likely the only country in the world with positive growth. Even China, which often doesn’t share all their economic data, may be experiencing deflation. It’s a highly contagious disease – like the measles currently making the rounds in California.

Here’s what I think: it’s really too late to do much of anything. The world machine has to crank through all this, waiting for the spark that generates a broad conflict. And when that broad conflict occurs, what happens? Governments run deficits to manufacture arms, and economic growth benefits. Lots of people die, but hey: at least the economy gets back on its feet. Isn’t it a pity we aren’t  smarter than this?

smarter than this?